High-performance global investing, with sharia

Tutorial on Islamic Asset Management

Safa proposes a unique combination of high-performance professional investing, but fully sharia certified.

Our investment approach follows carefully Modern Portfolio Theory, backed by decades of progress and research to optimize allocations for their best-fit risk and return characteristics.

Modern Portfolio Theory applies to all investors, whether they are Muslim or any other faith, as is widely used as the primary method of allocating assets in their most efficient form.

Read the following 5-part tutorial to learn more.

Social Responsibility & Ethics

The core principles of sharia are serving God, family and community, principles shared across all major faiths. Most important, Islamic investing requires investing in the real economy: no hedge funds, no derivatives, and no investments that are not backed by true, cash-flowing underlying assets or in real assets.

By investing according to sharia one avoids excessive debt, industries of questionable moral value, and an inherent respect for the community.

We believe sharia-compliant investing is among the most socially responsible investment strategies available to investors today, meeting strict ESG and SRI standards.

#1 An Introduction to Islamic Wealth & Asset Management, by Dr. John A. Sandwick

My doctorate represents the first time any scholar has combined sharia with the science of asset management. The science of investing has been around for about 70 years, what we call Modern Portfolio Theory.. It applies to both individual and institutional investors. But, until now no one applied the moral compass of sharia to the science of investing. That’s the biggest achievement of my doctorate.

The five tutorials here are meant to reveal some simple truths about how to invest savings. Please let me know if this is useful. Write to me at john@safainvest.com.

#2 The Science of Asset Management

In Switzerland we have over $3 trillion in assets under management, all of it managed according to Modern Portfolio Theory.

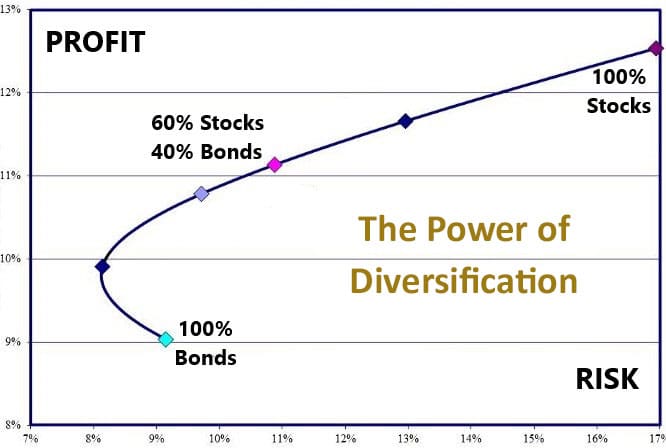

Diversification is key. Investments are in four categories: Cash, Bonds, Stocks and Alternatives. Investments are made in America, Europe, Asia and around the world. Data and research support sophisticated asset allocation tools to create optimized, diversified global portfolios.

Over the last 30 years diversified investing made an average of 8% or more per year. Modern Portfolio Theory has been generous to those who save.

The beauty of Modern Portfolio Theory is that it can deliver the same kind of results in the future. One does not need to worry about low rates in Europe, slow economic growth in America, or the next global financial crisis. Over time these things are unimportant. The potential for human economic activity is unlimited. In this sense, history will repeat itself.

#3 Introducing Sharia to Modern Portfolio Theory: Combining the Science of Investing with Respect for Sharia

Credit Suisse, JPMorgan, UBS and all other asset managers rely on Modern Portfolio Theory to make portfolio investments. But, until now no one added sharia to this science.

What is sharia? Muslims know it’s about principles laid down in the Koran that encourage ethical behavior. Number one, it prohibits interest. But, it also avoids unnecessary speculation, buying assets that don’t exist (derivatives) and avoiding haram activities.

For investing, this means no bonds, hedge funds, or shares of companies that violate sharia.

My doctorate took the current universe of Islamic investments (all liquid, meaning they could be sold at any time for cash) and constructed portfolios according to Modern Portfolio Theory.

These Islamic portfolios were then matched against identical investment strategies from major global asset managers. The result? In almost every case the sharia-compliant portfolios had more profit with less risk.

#4 What this Means for Muslims (and even non-Muslims) & the Asset Management Industry

Until now Muslims did not have a choice. They only had Modern Portfolio Theory without sharia. We estimate at least $400 billion of Muslim-owned money under management in Switzerland, and more around the globe. Almost none of this follows sharia.

My doctorate shows that Muslims now do have a choice. They do not need to sacrifice their beliefs when it comes to investing their savings. And, following sharia indicates more profit with less risk. Everyone wants that.

Doctorates are required to provide statistical proofs to support their hypotheses. Rigorous analytics are tested and retested. Only after peer review can a doctorate claim to add knowledge.

What we have now is important. Islamic wealth and asset management are not only possible, they are statistically superior to conventional investing.